AuraQ has vast experience helping organisations find the gaps that can be filled to enhance their business. This could be to improve efficiency, integrate legacy systems or deliver new portals and strategic applications to create competitive advantage. Contact us to request a free, no obligation Gap Analysis.

Ed Broking

The Professional and Executive Risk team at Ed Broking wanted to reinvent how they offered their Fund Sentinel solution - a fund directors’ & officers’ liability insurance product. The team needed a solution that would ensure their product remains competitive with a fast and efficient buying process.

Ed Broking is a global wholesale insurance and reinsurance broker with offices in the world’s key regional and global insurance centres. A Lloyd’s broker, Ed has expertise in all major lines of business offering a broad range of specialty insurance products including property and casualty, marine, financial and political risk, aerospace and cargo. Making insurance products simple and accessible is key to Ed’s success and the Professional and Executive Risk (ProEx) team were looking to redesign the way in which professional and corporate risk liability insurance was placed. They required a solution that could streamline the underwriting process but also provide an instant quote and bind capability which was user-friendly, market-leading and attractive to customers.

Administrative overheads reduced by 80% through removing labour-intensive data entry and manual document generation.

Generating quotes and binding policies incredibly simple, indicating in as little as 30 seconds and quoting and binding in under three minutes.

With a bespoke solution, ProEx now has a process that is 100% reflective of their business.

Ed wanted to work with a partner that could deliver all of our technical aspirations but also with a team that would provide continuity, offer advice on how best to digitally take our product forward and deliver a future proof solution - AuraQ - delivered all of this and more.

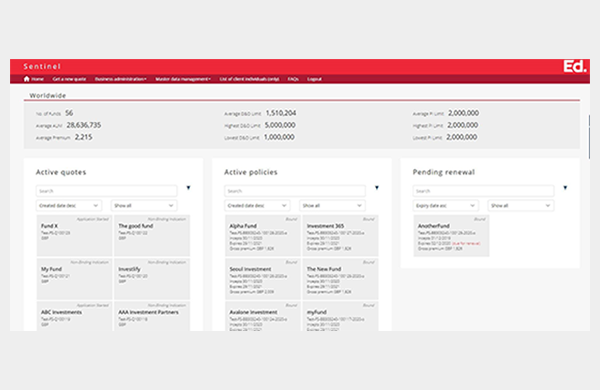

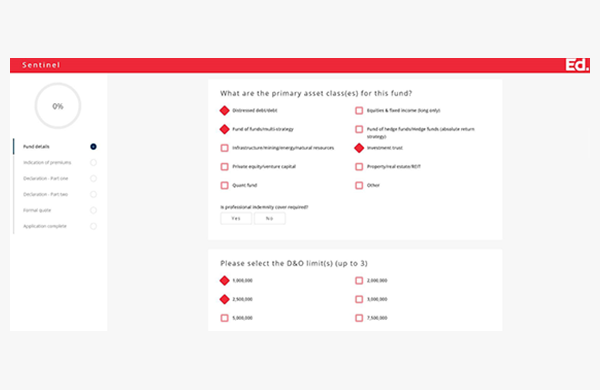

Nick Bachmann, Divisional Director of Professional & Executive Risk, Ed BrokingEd Broking had already invested in low-code application development platform, Mendix, to drive digital transformation across the enterprise. Seeking an expert development partner, Ed Broking engaged with AuraQ to implement a solution that could provide process efficiencies but also deliver a super-intuitive user experience alongside the ability to very quickly generate quotes and bind new Fund D&O policies. In just 8 weeks, AuraQ implemented a new Fund Sentinel Portal which delivered not only functional parity but also included enhancements and a full migration of all existing policies. The portal now makes the process of generating fund insurance quotes and binding policies incredibly simple, without the need of even having to speak to a broker. The whole process takes a matter of minutes, indicating in as little as 30 seconds and quoting and binding in under three minutes. Everything is now accessible online in a central repository and reporting has been transformed with Lloyd’s now updated via digital files.

Administration overheads alone have been reduced by as much as 80%. Removing labour-intensive data entry tasks and manual document generation has allowed the team to focus on core business development activities. The portal has been received exceptionally well by Ed’s customers who have welcomed the streamlined process. The intermediaries no longer have to complete proposals, create documentation or chase brokers – formal quotes are now created online with real-time checks completed in a fraction of a second. Continuing to build on their reputation as a leading insurance innovator, the ProEx team is aiming for an almost entirely non-touch process to Fund D&O procurement. The integration opportunities appear endless, and this could also include introducing other automation technologies such RPA and AI. Fund Sentinel is growing rapidly. As of today, there are over 330 funds on the portal and a gross written premium into the millions of dollars amd the speed at which the ProEx team can now deliver a Fund D&O solution to the funds industry is market leading.