AuraQ has vast experience helping organisations find the gaps that can be filled to enhance their business. This could be to improve efficiency, integrate legacy systems or deliver new portals and strategic applications to create competitive advantage. Contact us to request a free, no obligation Gap Analysis.

Besso Insurance

Besso is an innovative (re)insurance broker who needed to set themselves apart from their competitors. They required a platform that would fulfil their bespoke customer needs, ease the day-to-day administrative burden of managing insurance programs and a solution that would support their new business targets.

Besso’s marine team provides a fresh approach to marine insurance broking offering a unique combination of experience, flexibility, strong trading relationships and state-of-the-art technology. Besso deals both directly with insurance buyers and wholesale brokers focusing on the marine business, building relationships with shipowners, and producing brokers alike.

Priding themselves on being innovative, the insurer had a clear vision of how they wanted to offer their marine insurance products. Their existing solution lacked a graphical and modern user experience and they were seeking a solution that could support their vision, nurture their future growth goals and replicate the drive and forward thinking of the business and its stakeholders.

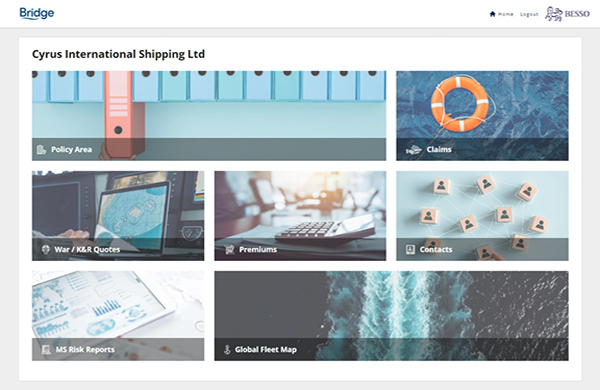

Clients have access to the platform and dynamic online library 24/7 via desktop, tablet and mobile.

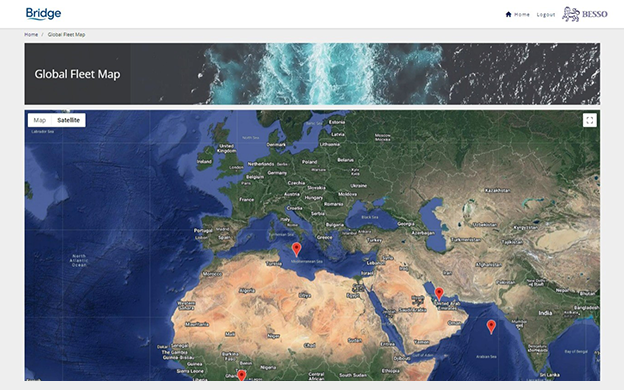

Fleet data is 100% accurate with visuals of real-time, global fleet positions and tracking via Google Maps.

Benefits realisation was achieved very quickly with phase one delivered in just 40 days.

It was important for the business to maintain creative control over the platform due to the specialist nature of marine insurance; AuraQ quickly demonstrated the skills to manage the project, interpret our needs as a business and deliver an outstanding application.

Carl Osbourn - Divisional Director, Besso MarineWhen establishing the retail marine division, Besso had provided the marine team with access to an external development resource who delivered a working solution to manage policy documentation to clients. The solution was developed using Microsoft SharePoint and, while SharePoint was adequate to meet the vast document management needs, it could not deliver the visual impact, functionality and advanced business logic required by the business.

Success of digitally delivering insurance products using the Mendix low-code development platform had already been proven across other business areas. The Besso marine team were introduced to AuraQ and quickly blown away by the possibilities available to them. With a clear set of requirements defined, the AuraQ team started development on a new bespoke marine insurance platform named Bridge. Bridge is a cutting-edge insurance administration and war breach platform that has been engineered to deliver all of the broker’s complex documentation needs while also providing extensive visual enhancements, superior workflow capability and connectivity to external third-party systems. The result is a market-leading platform. A platform that has the ability to be agile and act quickly to changing insurance needs while delivering all the complexities involved with marine insurance. With phase one delivered in just 40 days, Besso marine were able to realise business benefit very quickly and are already scoping ways in which to further develop and enhance Bridge to include extended integration features and API capabilities.