AuraQ has vast experience helping organisations find the gaps that can be filled to enhance their business. This could be to improve efficiency, integrate legacy systems or deliver new portals and strategic applications to create competitive advantage. Contact us to request a free, no obligation Gap Analysis.

(Re)Insurance broker delivers marketing-leading portal with low-code

Universally, there has been a rapid increase in the speed in which insurers are implementing digital agendas. The pandemic has been a big contributor, boosting the take-up of new technologies. As many as 85% of insurance CEO’s say that COVID-19 has been a digital catalyst (KPMG report: Insurers race to digitize) for their organisation. Changes that previously would have taken years are now being implemented in months and low-code has proven to be a big enabler for this.

Specialty (re)insurance broker, Ed Broking, recognised very early on that the use of digital technologies would strengthen their position as an innovation leader within the insurance sector. Wanting to challenge the traditional methods, the broker chose low-code for the rapid build of applications at scale and pace. Ed has quickly seen success across the business; executing market-leading digital solutions in a very short period of time and reducing administrative overheads by as much as 80%.

Reinventing insurance product offerings

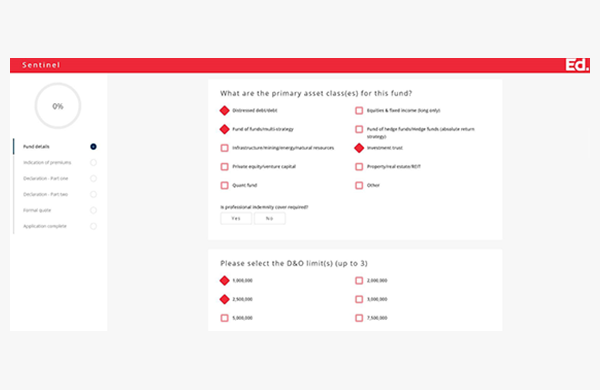

Ed Broking describe themselves as redefining broking for a changing world. The Professional and Executive Risk (ProEx) team at Ed, who provide fund directors’ & officers’ liability insurance, wanted to reinvent how they offered their Sentinel product. The objective was to deliver a super-intuitive user experience and a solution that could evolve with the business and its transformation goals. For the insurance industry, low-code can provide a quick way to build out new ideas and as an innovator, Ed recognised that the technology could offer a rapid way to deliver their forward-thinking mindset. They wanted to replace the traditional paper-based processes, typical of insurance companies, and knew that reforming the inefficient means in which this type of risk is placed would take more than an off-the-shelf solution. To support them, Ed engaged with AuraQ to implement the new portal – Fund Sentinel – built on the Mendix low-code platform.

Delivering a digital vision with Mendix

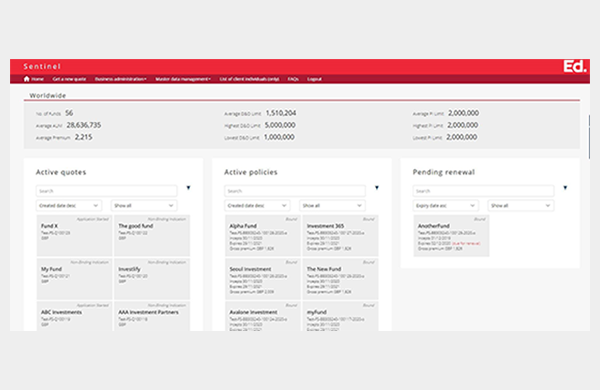

Through the portal, Ed’s ProEx team now has a solution that delivers a streamlined underwriting process and a quote and bind capability that is user-friendly, market leading and attractive to customers. Formal quotes are now created online with real-time checks completed in a fraction of a second. The portal makes the process of generating fund insurance quotes and binding policies incredibly simple, indicating in as little as 30 seconds and binding in under three minutes.

Building the solution on the Mendix low-code platform not only allowed dramatic improvements in processing time but it also allowed Ed to incorporate bespoke requirements. The streamlined process has been welcomed by Ed’s customers and Ed firmly believe that they have a process that is 100% reflective of their business. Low-code has allowed the insurer to rapidly deliver requirements that would not have been possible in such a short space of time with legacy solutions. Ed is now able to provide automated renewal management, premium payment reconciliations and enhanced reporting including integration to Lloyd’s.

Embracing digitalisation to realise success

As the insurance industry continues to experience a dramatic shift in how they offer products, low-code has been proven to help deliver accelerated digital roadmaps. Success at Ed has been shown in many ways, not least with an 80% reduction in administrative overheads. Insurance companies need to be able to rapidly react to market changes so that they can provide new products and services at pace and provide a seamless digital experience. The speed at which the ProEx team can now deliver a Fund D&O solution to the funds industry is market leading. Embracing low-code across the organisation means that Ed now has a configurable platform which is supportive of their digital growth. Using Mendix, they continue to build on their reputation as a leading insurance innovator and aim to deliver an almost entirely non-touch process from start to finish.

To read more detail about how Ed Broking used low-code to drive digital innovation and implement a bespoke, future-proof solution, download our case study.